Updating W4 Address

Updating Your W4 Address

IMPORTANT NOTE: Updating your W4 address does not update your State Withholding Information. If you change your state of residence, you must update your state tax withholding using these instructions: Changing Residency- State Withholding. Updating your phone number is optional.

This direct link will take you to the Personal Information screen. You will be prompted to use SSO to login. Otherwise, click the GWeb link below and follow the steps to arrive at the Personal Information screen.

To begin, log in to GWeb.

From the home screen select View/Update Personal Information under My Profile to review and/or update your address(es).

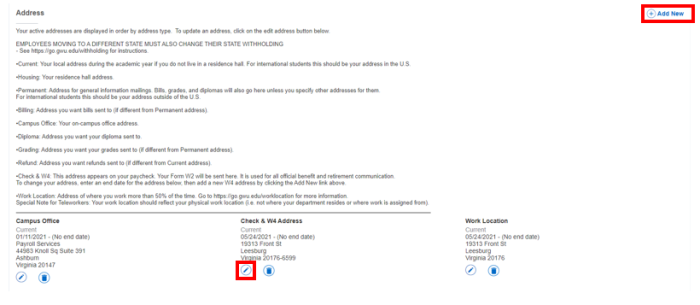

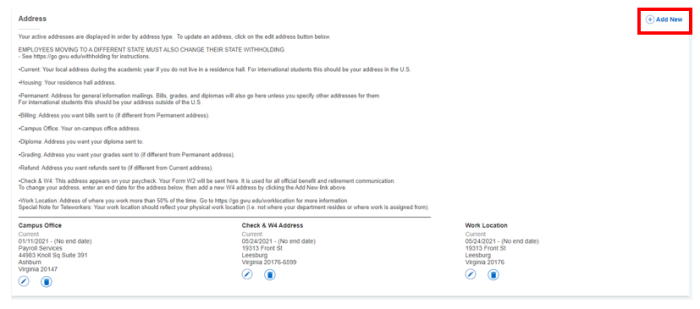

On the Personal Information Screen, scroll down to the Address section. Click Edit on the Check & W4 Address. Click Add New if a W4 address doesn’t exist and skip the next 2 steps.

Enter an end date in the Valid Until Box. Click Update.

Click Add New.

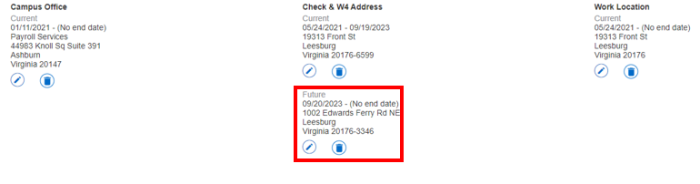

Enter the Type of Address and a Valid From date. Leave the "Valid Until" box blank. Enter applicable address details. Click Add.

You will see your new address on the Personal Information screen.