Faculty and Staff Open Enrollment Benefits Overview

2026 Open Enrollment Period: October 6 - 24, 2025

Dear George Washington University Community,

Welcome to the 2026 Benefits Open Enrollment season! Open Enrollment begins on Monday, October 6, 2025 and ends at 8 p.m. (ET) on Friday, October 24, 2025.

Open Enrollment provides an annual opportunity to reflect upon your current benefit elections and make any needed changes for the upcoming 2026 calendar year, including adding or removing eligible dependents. Any changes to your health and welfare plans must be completed during the 2026 Open Enrollment period*, with most changes going into effect on January 1, 2026.

If you choose not to take action, your existing coverage options from 2025, including medical/prescription, will roll over into 2026, with the exception of the Health Care Flexible Spending Account (HCFSA) and Dependent Day Care Flexible Spending Account (DCFSA) options, which the IRS requires you to actively re-enroll for each year.

Open Enrollment Events

This year’s Open Enrollment period will offer both in-person and virtual opportunities for support. We invite you to join us for our annual OE Fest experience, where activities vary by location and may include complimentary vision screenings, vaccine clinics, massages, and more. You’ll also have the chance to speak directly with GW benefit plan providers and receive assistance with the enrollment process.

Virtual webinars, hosted by our vendor partners, will be offered throughout OE to provide detailed information about the 2026 benefit programs.

New this year, we’re introducing a Benefits Enrollment Support Drop-In event on October 23—a smaller, one-stop opportunity designed to help you make informed decisions about benefits tied to Open Enrollment. At this event, you can explore benefit options, ask questions, receive personalized guidance from the GW Benefits team and participating vendor partners, and complete your enrollment on-site.

Please mark your calendar and be on the lookout for chances to win exciting prizes and swag this Open Enrollment season.

1:1 Appointments

Have questions about your 2026 medical plan? Register for a 10-minute appointment with Aetna. Appointments are one-on-one and offer you a chance to ask questions specific to your situation.

Our Benefits Call Center and our team are always here to help you along the way.

Be well,

GW Benefits

*Changes requested outside of Open Enrollment must be accompanied by a Qualified Life Event.

Online Enrollment via the GW Benefits Enrollment System

During the Open Enrollment season, employees will elect benefits through the GW benefits enrollment system, which has single sign-on capability. When you are logged into your GW computer with your UserID and password, you will automatically be able to enter the enrollment system to elect and/or make changes to benefits for 2026. When logging in to the enrollment system from a non-GW computer, you will be prompted to log into Microsoft online and will subsequently enter the enrollment system.

Benefits Call Center

The Benefits Call Center is here to support you as you review your benefit elections and make your Open Enrollment decisions. As you elect benefits via the GW benefits enrollment system, benefits counselors are available to help answer questions along the way. The service is available M - F, 8:00 a.m. - 8 p.m. ET. Please have your GWID available.

On the Go? Download the mobile app, enter our company code GWbenefitscenter, along with your GWID and password (date of birth in MMDDYYYY format) and take your GW benefits with you wherever you go.

We are Here to Help

Email any questions to benefits gwu [dot] edu (benefits[at]gwu[dot]edu). Or, call the Benefits Call Center at 833-698–0324.

gwu [dot] edu (benefits[at]gwu[dot]edu). Or, call the Benefits Call Center at 833-698–0324.

Reminder: Give your address a checkup!

Each year, take some time to review and confirm your Campus, Check & W-4 and Work Location* addresses in GWeb to ensure you receive timely information. Log in to GWeb and access the Employee Information tab to confirm and / or update your address information.

*Work Location is defined as the physical location where you are working more than 50% of your time.

Benefits Overview

It is important to prioritize your health and well-being goals. Open Enrollment 2026 provides the opportunity for you to reevaluate your current workplace benefits and make intentional choices for the year ahead that will allow you to maximize your health and well-being.

Please take a moment to review this summary of what’s changing and what’s staying the same for the upcoming year. Join us for a virtual Coffee Chat where we will provide an overview of your 2026 benefit offerings including our new medical vendor partner, introduce our 2026 Open Enrollment Guide, highlight important features of the GW Benefits enrollment system, and recap well-being programs available to you and your family.

Vendor Change: Aetna as GW's Medical Plan Administrator for 2026

Beginning January 1, 2026, GW will partner with Aetna as the new administrator of GW's medical plans. This means Aetna will take over administration of our medical plan offerings (GW PPO and GW Health Savings Plan (GW HSP)), replacing our current provider, UnitedHealthcare. Note: Prescription drug coverage will continue to be provided through CVS Caremark.

There will be no changes to the medical plan designs or lapse in coverage—only the administrator is changing. The plan designs including deductibles, coinsurance, co-pays, out of pocket maximums, etc. remain the same. The provider network, service experience, and support tools will transition to be managed by Aetna.

Note: If you do not take action during open enrollment, your current medical election, i.e. GW PPO or GW HSP will automatically roll forward.

As part of the transition to Aetna as our medical plan administrator in 2026, employees can expect several enhancements designed to improve the overall healthcare experience. These service improvements aim to make it easier for you to access care, navigate your benefits, and receive personalized support, while maintaining the quality and coverage you rely on.

- Enhanced Member Support: Dedicated customer service line for GW employees, offering personalized assistance

- Improved Digital Tools: Access to Aetna’s enhanced member portal and mobile app for easier navigation of benefits, claims, and provider searches

- Expanded Provider Network: Broad national network that maintains access to most current providers while offering additional in-network options

- Simplified Navigation: Streamlined coordination for claims, referrals, and pre-authorizations

- Focused Health Resources and Communications: Access to timely wellness communications and care management programs tailored to chronic conditions, preventive care, and mental health support

Note: For those newly enrolling or continuing medical coverage through one of the GW medical plans, Aetna ID cards will be issued via mail. Be sure to provide your doctor with your new Aetna member details for coverage information and claim processing.

For more information, please join us for an upcoming webinar with Aetna.

Tip! Want to check if your preferred provider is in-network before the transition?

Visit www.Aetna.com and follow these steps:

- Click “Find a doctor” at the top of the page.

- Under the “Don’t have a member account?”, Select “Plan from an Employer”.

- Under "Continue as a Guest", Enter your ZIP code.

- On the next screen, under "Select a Plan", scroll to “Aetna Open Access Plans" and select "Aetna Choice POS II (Open Access)” as your plan and click "Continue".

This will help you confirm whether your provider is part of Aetna’s network.

2026 Health Plan Contribution Increases

Employee contributions for the faculty and staff Medical Plans will increase by 6.5% in 2026 (across all salary bands and plans). Approximately 65% of full-time medical plan participants will see an increase of less than $20 per month. The monthly employee contribution increase will range from approximately $3 to about $61, depending on your coverage level and salary band. As noted above, there will be no changes in plan design e.g., deductibles, copays, coinsurance, etc.

Below are three examples of the monthly medical contribution increase for full-time benefits-eligible employees. Please note: Contribution details for all pay frequencies will soon be available in the Open Enrollment Guide.

- If the employee enrolls in the GW HSP or PPO for individual coverage, the average medical contribution increase will be about $6 or $10 per month, respectively, for 2026.

- If the employee enrolls in the GW HSP with family coverage, the average medical contribution increase will be about $26 per month for 2026.

- If the employee enrolls in the GW PPO with family coverage, the average medical contribution increase will be about $49 per month for 2026.

Note: There will be no changes to the current salary bands.

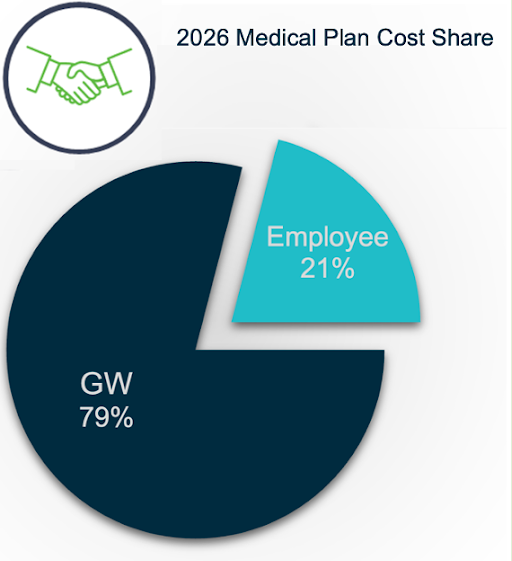

Our commitment and shared responsibility:

While medical and prescription costs continue to rise, GW remains committed to offering health benefits that deliver value to you and your families, with competitive coverage and cost sharing. Plan costs have increased over the past two years at higher levels than we've seen in many years. During this time, GW has worked to limit increases in overall program cost and employee contributions. Changes we are making for 2026, including moving our medical plan administrator from UnitedHealthcare to Aetna, have allowed us to maintain the portion of plan cost paid by GW and still mitigate increases in employee contributions.

*Percentages are rounded and reference averages based on all salary bands, medical plans and tiers of coverage.

As we expect continued upward pressure on the cost of our medical plans, it's important to remember we all play a part in helping control costs.

Our medical plans are self-insured, which means the university pays the claims. Aetna will process the claims from health providers for GW faculty and staff and their covered dependents.

Our premiums for the medical plans are based on our claims experience. High volume and / or high-cost claims in a year have a direct impact on the premiums we pay as participants in the following year.

You can help. When you get regular wellness visits, timely screenings, use in-network providers, and thoughtfully consider care, you generally incur less in claim costs, which has a direct impact on next year’s premiums.

Reminder: MFA TIER

The GW PPO and HSP medical plans include a separate benefit coverage tier for Medical Faculty Associates (MFA). When GW medical plan participants see an MFA provider*, they receive lower co-payments and lower employee coinsurance, helping your medical expense dollars go further because a greater portion of your care will be covered by the Plan.

GW employees also have a dedicated phone number to schedule appointments: 202-677-6000.

*The MFA tier applies to professional charges by MFA providers, MFA behavioral health providers continue to be out of-network.

2026 Dental Contribution Overview

Dental premiums for GW’s dental plans are increasing, and employee contributions will

Tip: Check out Headspace

Headspace, the mindfulness app, is available at no cost for benefits-eligible faculty and staff. The app includes guided meditations, sleep programs, exercises, and more. Kids' programs include themes such as calm, kindness, and bedtime.

IRS Account-Based Plan Updates

2026 Flexible Spending Accounts (FSA) Contribution Limits

- The annual maximum for the Health Care FSA will remain the same at $3,300.

- The annual maximum for the Dependent Day Care FSA will increase from $5,000 (or $2,500 if you and your spouse file separate tax returns) to $7,500 (or $3,750 for married individuals filing separately).

2026 Health Savings Account (HSA) Contribution Limits

(combined employee + GW contribution)

- For those with individual Health Savings Plan (HSP) coverage, the annual maximum for the HSA will increase by $100 to $4,400.

- For those with family HSP coverage, the annual maximum for the HSA will increase by $200 to $8,750.

- GW’s HSA matching contribution continues: GW will match dollar for dollar up to $600 for those enrolled for employee-only coverage and up to $1,200 for those covering dependents under the GW Health Savings Plan.

Note: If the IRS announces increases to the FSA maximum amounts noted above during / following the Open Enrollment period and you have elected for 2026, you will be notified via email and have the opportunity to make a change to your election by the deadline provided.

Tip: Take Advantage of an FSA or HSA

With an FSA or HSA, you can set aside pre-tax dollars from your paychecks for eligible healthcare expenses. These accounts can help you cover expected (and unexpected) health expenses while lowering your taxable income, which can save you money.

Optional Life Insurance

During Open Enrollment, employees who have optional employee life insurance coverage below $250K, or are not yet enrolled, can elect up to an additional $250K of coverage without EOI.

Employees with $250K or more in optional employee life insurance can increase their coverage up to the new GI of $500K without EOI. Here are a couple of examples:

- If you are currently enrolled with $100K, you can elect up to $350K without EOI

- If you are currently enrolled with $350K, you can elect up to $500K without EOI

Important: Anyone who previously declined coverage on the basis of EOI must submit EOI for any increase.

What's Staying the Same for 2026?

The following programs and benefits will continue to be available in 2026.

Health & Well-Being Benefits

- Disability Insurance

- Family Care Benefits from Bright Horizons

- Group Home and Auto Insurance

- Health Advocate

- Headspace

- Legal Benefit

- Capital Bikeshare

- SimpleTherapy

- Active & Fit Direct

- Critical Illness

- Hospital Indemnity

- Real Appeal

- Pet Insurance

- Identity Theft

- GW Employee Assistance Program (EAP)

- Progyny Pregnancy and Postpartum Support (available to both GW PPO and GW HSP participants)

- Progyny Fertility and Family Building (available to GW PPO participants)

- Tobacco Cessation

Medical Plan Features / Programs

- Centers of Excellence

- Freestanding Imaging and Labs Preferred Network

- Virtual Visits

- GW Medical Faculty Associates (MFA) Benefit Coverage Tier on the PPO and HSP Medical Plans

Pharmacy Benefit Features

- PrudentRx Pharmacy Benefit

- Mandatory Maintenance Choice - All Access with Opt-Out

- Diabetes Management Program with Hypertension

DID YOU KNOW?

Your UHC Vision plan includes express vision exams (some state restrictions apply), a broad pediatric vision benefit, expanded benefits for women who are pregnant or breastfeeding, and a hearing discount.

Tip: Try Health Advocate

Receive personalized, prompt, and reliable expert help in navigating the healthcare maze, while saving time and money, with Health Advocate. Need assistance understanding your medical bills, or looking for more information about treatment options? Health Advocate can help you and your family members at no cost. For details, visit Health Advocate.

Tools, Information, and Services Available to You

The annual Open Enrollment period is a time of opportunity. As you review the 2026 benefit programs, you are welcome to include your family in the planning process, if applicable.

Several resources and information sessions are made available to you during the weeks leading up to and during Open Enrollment. We encourage you to attend our open enrollment events, including our in-person fests, benefits enrollment support drop-in, virtual webinars, and 1:1 appointments to ask questions as you choose plan(s) and benefits that are the best fit for you and your family.

View the Open Enrollment Events

Virtual Coffee Chat with Benefits

Join GW Benefits for an upcoming virtual coffee and chat session as we provide an overview of your 2026 benefit offerings including our vendor partners and benefit programs, introduce our 2026 Open Enrollment Guide and enrollment deadlines, highlight important features of the GW Benefits enrollment system and recap well-being programs available to you and your family.

Grab a coffee on us! Registrants for each session will be entered into a coffee gift card raffle.

• Friday, September 26, 2025 | 10 - 11 a.m. ET

• Thursday, October 2, 2025 | 1:30 - 2:30 p.m. ET

Event registration information is available at go.gwu.edu/2026oeevents.

Flu and COVID Vaccines

In partnership with the Medical Faculty Associates (MFA), flu and COVID vaccine clinics will be held at the Foggy Bottom Campus and Virginia Science and Technology Campus (VSTC) during October including on the open enrollment fest dates. Those who wish to receive their vaccine(s) at one of the clinics are strongly encouraged to register in advance. Insurance Information will be collected during the registration process. GW Faculty and Staff enrolled on a GW medical plan, please have your UHC ID card available when registering. For more details, visit GW Flu and COVID Vaccines Services.

Employees covered by a GW medical plan can also visit area pharmacies and convenience care clinics to receive a flu shot and COVID shot at no cost. If visiting one of these, please present your CVS Caremark ID card.

If you are not covered on a GW medical plan, please verify costs with your health insurance company. Most plans will cover the full cost of seasonal flu shots.

Please note: If you require a high-dose flu shot, generally recommended for those over age 65, please consult with your healthcare provider or pharmacy in advance regarding availability.

The GW Benefits Enrollment System

Beginning October 6, 2025, employees may log in to the GW benefits enrollment system to review, change, or select your benefits options. You are allowed to log in to the enrollment system and make changes as often as you would like during the three-week Open Enrollment period.

The deadline to make changes is 8 p.m. (ET) on October 24, 2025. Please remember that most changes made during the Open Enrollment period become effective January 1, 2026.

Tip: Add Dependents and Keep Beneficiary Information Up-To-Date

If adding a new dependent to coverage during Open Enrollment, supporting documentation (e.g. copies of birth or marriage certificates) must be received by Benefits by Friday, October 31, 2025. You can submit documentation two ways:

- You have the ability to upload documents in your Employee Profile on the confirmation page (at the top of the screen, click My Profile, then click Employee File) after making your benefit elections in the benefits enrollment system; or,

- You may submit your supporting documentation via email at benefits

gwu [dot] edu (benefits[at]gwu[dot]edu) or fax at 571-553-8385. If emailing, please be sure to send via secure email.

gwu [dot] edu (benefits[at]gwu[dot]edu) or fax at 571-553-8385. If emailing, please be sure to send via secure email.

Each year it is also good practice to review your life insurance beneficiaries during open enrollment. While Beneficiaries can be changed at any time during the year, this may be a good time to review and update the information if necessary. Visit go.gwu.edu/enroll4benefits to review.

In the coming weeks:

- You will receive more detailed information regarding 2026 Open Enrollment.

- The 2026 Open Enrollment Guide will be available prior to the Open Enrollment period and linked as a quick reference in the enrollment system.

- If you have any questions in advance of the 2026 Open Enrollment period, please contact the Benefits Call Center at 833-698-0324 or email benefits

gwu [dot] edu (benefits[at]gwu[dot]edu).

gwu [dot] edu (benefits[at]gwu[dot]edu).

Reminder: 1095-C Tax Form Electronic Consent for Faculty and Staff

Did You Know that you can receive your 1095-C form electronically now? Save time, support sustainability, and keep things secure. Login to go.gwu.edu/enroll4benefits to complete your online consent form to receive your 1095-C electronically. Once available, your form will be securely posted and stored in your employee file.

What is a Form 1095-C?

Eligible employees will receive a Form 1095-C tax document annually, which reports information about your medical coverage.

While you will not need to include your 1095-C with your tax return filing or send it to the IRS, you may need information from your 1095-C to help complete your tax return. Think of it as your “proof of medical insurance” for the IRS.

Please contact the Benefits Call Center at

833-698–0324 with any questions

you have in advance of the Open Enrollment period.