VA-MD-DC Changing Residency - State Withholding

VA-MD-DC Changing Residency - State Withholding

- Only VA, MD, and DC can be updated in GWeb. For other states, visit the Payroll Forms page and submit the completed forms to payroll

gwu [dot] edu (payroll[at]gwu[dot]edu).

gwu [dot] edu (payroll[at]gwu[dot]edu). - This is a 2-step process. Step 1: Deactivate your current state withholding. Step 2: Activate new state tax withholding.

Step 1:

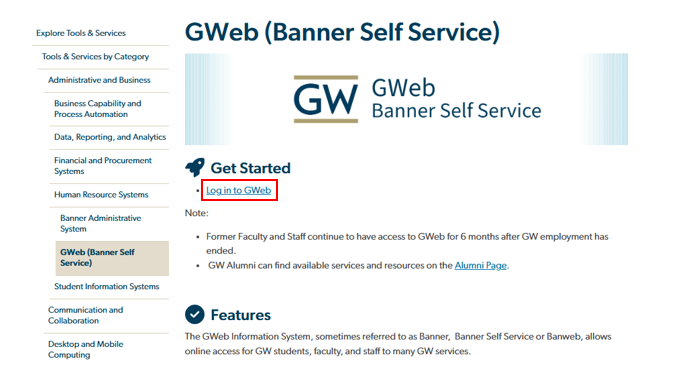

To begin, log in to GWeb.

In this example, the employee is changing from MD to DC State Taxes. Click View/Update VA-MD-DC State Tax Withholding.

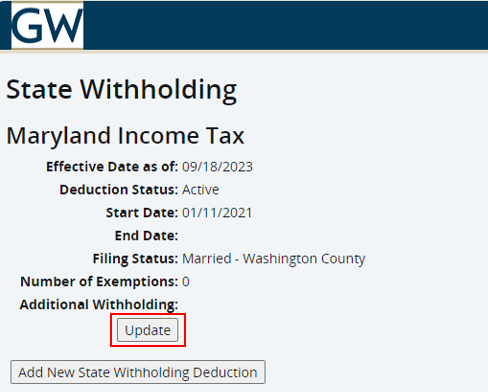

Click Update.

Choose a date in the current or a future pay period. See the payroll calendar for help. Check the box to inactivate MD. Check the box to consent and Click Certify Changes.

Click Return.

Step 2: How to set up new state withholding

Click Add New State Withholding Deduction.

Choose the state you are adding.

Choose the day after the effective date of the inactivated state tax. See the payroll calendar for help. Update your filing status, number of exemptions, amount for additional withholding (leave blank if 0), or claim Exempt. Check the consent box and click Certify Changes.

Click Return.